Yesterday, Vickie Ayres, The Countess of QuickBooks, hosted our free monthly QuickBooks webinar and discussed the topic of how to pay and reimburse yourself in QuickBooks. She also demonstrated clever ways of making sure everything is tracked in QuickBooks properly. Below is an article from Vickie based on the webinar. The recording of yesterday's webinar will be available for purchase in our shopping cart next week.

Paying and Reimbursing Yourself in QuickBooks

by Vickie AyresHow to decide to pay and reimburse yourself can be a difficult question, especially when you first open your business. Almost all new businesses have to re-invest most of their profit back into the business. Think about how much it would cost to replace yourself doing the tasks you do. If you hired someone to do your job, what is the going rate in your area? That is the minimum base rate you should choose to pay yourself. Some business owners pay themselves based on a percentage of the job, sometimes that is easier in the beginning when cash flow is tight.

After deciding how much, let's look at how to enter that in your QuickBooks company file. You will want to discuss this with your accountant of course, as everyone's entity and personal situation will vary. If you create payroll for employees, you can make yourself an "Employee" and pay yourself, letting payroll taxes accrue as you go along. This is how I have paid myself for years. Pay as you go and even it all up at the end of the year on your tax returns.

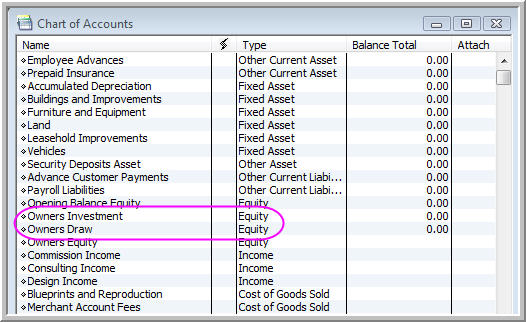

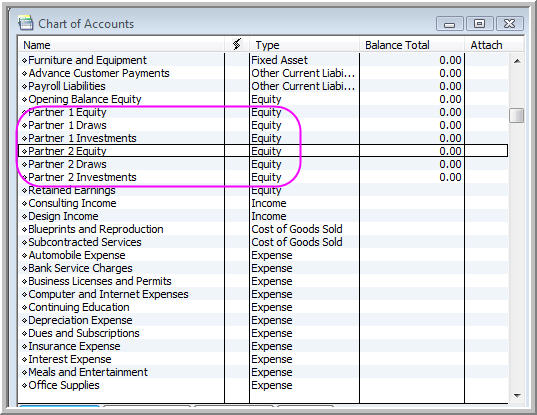

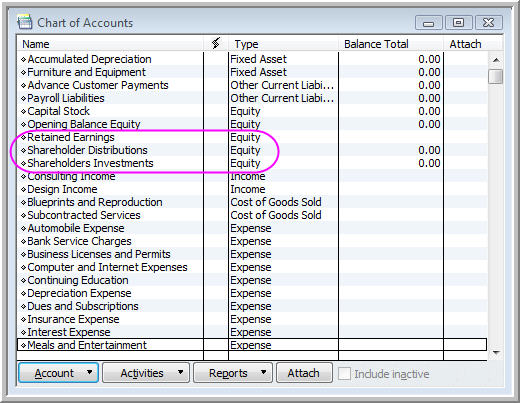

You need two accounts in your Chart of Accounts to show money drawn and money invested. Depending on your entity type there will be different account names for each entity. Essentially, whether it is a Partner Draw or an Owners Draw, the name is different but the concept is the same. Your company has money, it isn't taxed yet, and you want to put it in your pocket. That's OK, it's your money.

Below are three examples of Chart of Accounts's set up as three different entity types, notice how they have similar names for the money drawn and money invested equity accounts?

Owner Draw

Owner Draw Partner Draw

Partner Draw  Corporation

Corporation What your accountant and the government care about is that when you take or put money into your company, you record that information correctly. Show how much you take and how much you put in, so the accountant can arrange it all on your tax return at the end of the year and assess the proper payroll and income taxes on it.

If you don't create payroll you can write yourself a "Draw" check, remember to use the equity account in your Chart of Accounts that is for draws, don't get hung up on the difference in names in the different types of entities. Here is an example of a check written to the owner of the company for $1000.00 as a salary.

The other thing you need to account for is business expenses that you make with personal funds or credit cards. Very, very important to keep track of these. You can do them as you go but most people let them pile up in a file and reimburse these expenses periodically. This money that you "invest" in your company is money you can take out of your company with no payroll or income taxes assessed; it is money the government has already taxed. Let's look at two ways to get that expense posted in QuickBooks and/or pay yourself back.

If you want to pay yourself back just write yourself, a check and use the appropriate expense account. If you used your personal credit card to buy some paper at Office Max, below is a check showing how to pay yourself back.

Now here is the really cool trick, how to enter the expense and NOT pay yourself back right now. We are going to create a "Zero Sum Transaction in a Clearing Account." Won't you look smart at your next tax appointment throwing that fancy phrase out on the desk? It's very easy!

- Create a new bank account called "Clearing Account" (List > Chart of Accounts > right-click, select "New" > Type, Bank > Save & Close.

- Now create a check and make sure you choose the "Clearing Account this time, the example below shows the same copy paper expense, but it makes an expense number for Office Supplies and an Investment entry for the amount invested.

- Notice there are two entries on the expense tab. The second entry uses the Owner's Capital: Investments account and the exact same amount in negative format was entered.

You can stack numerous transactions on the same check here. Simply list all of the transactions with explanations and make just one entry with the negative number for the investment, like this...

If you use QuickBooks in your design business you need Minutes Matter QuickBooks & Quoting! Included with your purchase is a free one-on-one set up with Vickie, The Countess of QuickBooks, to make sure you're off to the perfect start with our QuickBooks & Quoting.